WASHINGTON, Oct 21, 2021 – U.S. Senator Bill Cassidy, M.D. (R-LA) today delivered a speech on the Senate Floor condemning Democrats’ plan to direct the Internal Revenue Service (IRS) to spy on Americans’ bank accounts. “The IRS does not have the right to spy on Americans’ bank accounts,” said Cassidy. “This is nothing less than mass, indiscriminate government surveillance on Americans. Giving IRS bureaucrats unfettered access to Americans’ personal, private finances is a gross invasion of privacy and an abuse of power.”

Cassidy and Senator Mike Crapo (R-ID) led a group of Republican colleagues demanding Democrats abandon their plan to have the IRS spy on law-abiding Americans earlier this month.

Cassidy’s speech as prepared for delivery can be found below:

Mr./Madam President,

The IRS does not have the right to spy on Americans’ bank accounts. Period.

We all know the list of reasons why Democrats’ $3.5 trillion tax-and-spending spree is a disaster. It will bury the American people in a mountain of debt, crushing inflation, and new taxes. The Committee for a Responsible Federal Budget warn this spree could exceed $5 trillion in terms of the deficit.

But aside from the economic disaster their tax-and-spending spree will cause, the White House and Congressional Democrats want to force banks to report details of every American’s bank account to the IRS.

This is nothing less than mass, indiscriminate government surveillance on Americans. Giving IRS bureaucrats unfettered access to Americans’ personal, private finances is a gross invasion of privacy and an abuse of power.

Democrats tell us this reporting requirement will only target the rich.

According to the New York Times, the Biden administration’s original plan was to have banks “provide data for accounts with total annual deposits or withdrawals worth more than $600.” 600 dollars! Over the course of a year!

I can’t think of anyone I know other than maybe an 8-year-old child who doesn’t have over $600 in transactions over the course of a year. This will lead to nearly every American falling victim to the Biden administration’s surveillance program.

If you are a small business owner, you will be spied on.

If you are a family looking to buy your first home, you will be spied on.

If you sell your neighbor some of your fishing rods, you will be spied on.

If you are a single, working mom trying to take care of your children, you will be spied on.

But now Democrats are saying they will raise the cutoff to $10,000.

However, they will not limit their espionage to transactions over $10,000—no. Their new plan is to spy on everyone who spends more than $10,000 annually out of a single bank account.

And there’s the rub. This changes nothing. Most every American will still fall within this category and be caught in Democrats’ surveillance dragnet.

If you pay rent, you will be spied on.

If you buy a new car to drive your children safely to and from school, you will be spied on.

This is clearly wrong.

On top of the clear violation of our right to privacy, this is also just terrible policy. The reporting requirements in Democrats’ tax-and-spending spree will create an unreasonable burden on banks and credit unions to record and report massive amounts of data.

Lastly, let’s think about why Democrats want the keys to your bank accounts—they need help paying for their $3.5 trillion tax-and-spending spree.

$3.5 TRILLION. They say they are going to catch ultra-wealthy tax cheats. This is not true. They are going to raid a working mom’s bank account.

Nobody wants people to cheat on their taxes. Republicans have always supported people paying the taxes they owe.

What we oppose is Democrats slamming through an ultra-partisan bill that will direct the IRS to spy on every single American under the charade that they want to catch tax cheats.

Democrats are showing us the harm a government can do when they don’t care about their citizens privacy. They are showing us their real priority is having power over the American people. This scheme is unacceptable, un-American and should be opposed.

With that, I yield the floor.

Cassidy Joins Scott, Colleagues on Bill to Block Democrats’ IRS Spying Scheme

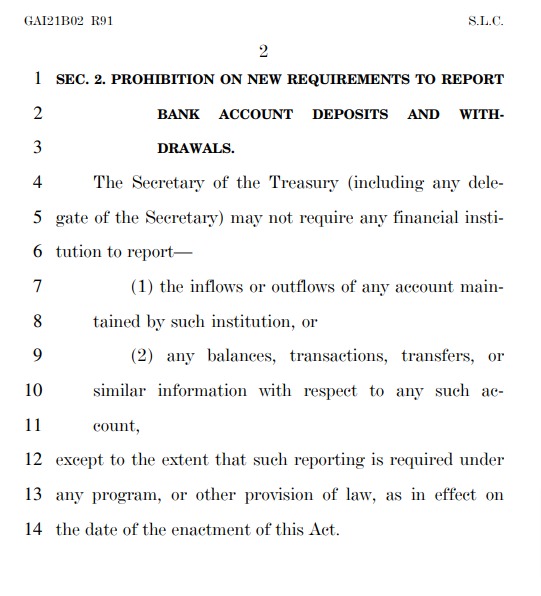

WASHINGTON – U.S. Senator Bill Cassidy, M.D. (R-LA) joined Senator Tim Scott (R-SC) and 47 other Republican colleagues in cosponsoring the Prohibiting IRS Financial Surveillance Act, a bill to block the Internal Revenue Service (IRS) from implementing plan to spy on Americans’ bank accounts.

“The IRS does not have the right to spy on Americans’ bank accounts,” said Dr. Cassidy. “This is nothing less than mass, indiscriminate government surveillance on Americans. Giving IRS bureaucrats unfettered access to Americans’ personal, private finances is a gross invasion of privacy and an abuse of power.”

The plan to allow the IRS to spy on the bank accounts of nearly every person in this country, even those below the poverty line, should be deeply concerning to anyone who values privacy and economic inclusion,” said Senator Scott. “Of the more than 7 million American households that are currently unbanked, the majority are low-income, rural, and minority Americans. Implementing the Biden reporting scheme will disproportionately harm those who need greater access to our financial institutions and people living paycheck to paycheck. My colleagues and I will not stop fighting the Democrats’ wrong-headed proposal to implement more federal government intrusion into our lives.”

Prohibiting IRS Financial Surveillance Act

Background

Cassidy delivered a speech on the Senate Floor condemning Democrats’ plan to direct the IRS to spy on Americans’ bank accounts.

The Prohibiting IRS Financial Surveillance Act would block the Biden administration’s plan to give the IRS access to the financial information of any American’s bank account that has annual withdrawals or deposits of greater than $10,000. Under the Biden reporting regime a family whose monthly expenses total just $833 would still be required to be reported to the IRS. Nearly every American, even those below the poverty line, would be subject to this proposed reporting regime.